It was in the 1950s that financial institutions came together and thought that it was necessary that a uniform method to value the creditworthiness of borrowers was necessary. A few leading banks commissioned the Fair Isaac Co. (FICO) to develop a set of scales and equations which can be used to determine how much of a credit risk a person is. The results are extrapolated into a commonly understood number that is now called the credit score. This score is used for us to determine who has bad credit or not.

The equations and scales developed are quite complex. If you really want to know how to derive the credit score the equations and scales are available to download although it really isn't worth the time to compute the results yourself. Computers can be used now to ask a series of questions about your bank details and billing details which can be outputted into a credit score.

The whole premise of the FICO score is to take all your previous financial information and credit history to predict your future performance with the loan or financing products. If you have a high credit score then it is more likely that you will follow the requirements of loans as you have previously so you are less of a credit risk and will be rewarded with a cheaper loan. Naturally if you have previously been poor with your financials you will have a low credit score and thus have to pay more for a loan as you are a higher credit risk.

There are currently 3 different reporting agencies which provide FICO scored. These agencies are Equifax, Trans Union and Experian. You, the lenders or just about anyone with access to your private information can access your credit score. It should be noted that the government has made it compulsory that each of these companies provide a person one free credit report every year. So you are actually entitled to 3 credit report every year for free.

A group of people are unhappy about the use of credit reports to signify the creditworthiness of an individual. They say that a person's credit report should consist far more than just a list of infractions and a credit score at the end. According to them each case should be evaluated separately as each person's financial situation differs from another person's. The unfortunate truth is that the FICO score has become such an important tool in determining a person's credit worthiness that we all have to be weary of it. Groups of people may object to its use but the fact is that its simple summary of a person, it proves invaluable. As such will continue to be used until the foreseeable future for anyone looking for loans.

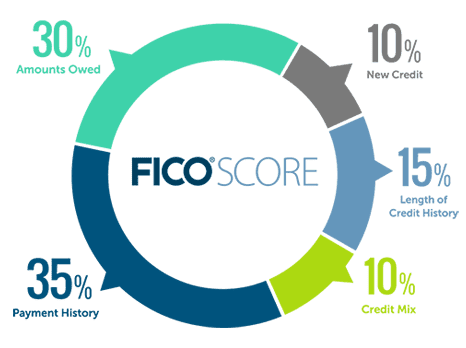

As mentioned earlier to actually dissect the FICO credit scoring system is tedious but there are a few factors that weight much larger than any other when it comes to determining your credit history. The biggest determinant is if you have been bankrupt before and also how long ago. The next biggest contributor is your frequency of late payments (particularly large loans), how much and if you settle your late payments in a timely manner. Your employment history and also how often you move from your primary residence also plays an important role. Your criminal record also plays a part in determining your credit score.

As mentioned earlier the largest factor in the calculation of your FICO credit score is naturally your credit history. Basically the lenders want to know how you performed in your previous loans or debt products so they can determine if you are worthy to obtain another loan or not. This is exactly why it is vital that if you want to apply for a loan that you have the best credit history possible so that you get the best rates and also stand a much better chance of having the loan accepted.

There are a few things that you can do before you actually apply for the loan that can help you increase your credit score in the short term so that your access to funds will be easier. You should always pay your bills, credit cards or any other financial product off and keep a 0 balance. You can refrain from applying for any financial product like credit cards etc for a few months before you take out a loan. You can draw down any revolving credit product up to 50% and no more. The percentage figure should be tapered down as you come closer to the date of application for your loan.

The fact is that most of us will have the bad luck of being a bad credit borrower at least once in our lives. What is important is how you deal with it and how you get yourself out of the hole before sinking deeper into it. If you need a bad credit loan then a few planned steps are necessary to make sure your application process results in a approved loan.

Post a Comment